- The exchange rate regime: The effect of a fiscal stimulus varies according to the country’s exchange rate regime. When exchange rates are fixed, the expansionary fiscal policy increases demand and leads to a higher output, which puts upward pressure on the interest rates. Central banks are therefore forced to respond with monetary accommodation in order to “defend” the exchange rate and ensure that the final output effect is not dampened. Conversely, in an economy with a flexible exchange rate regime, the effect of fiscal stimulus will be weakened through higher interest rates and appreciation of the domestic currency, leading to a decline in investments and net exports. Therefore, the fiscal multiplier is higher in countries with a fixed exchange rate compared to those with a flexible exchange rate regime.

- Trade openness: Theoretically, the fiscal multiplier is expected to be lower (higher) in countries characterized by a higher (lower) marginal propensity to import. According to economic theory, a rise in domestic income – in the aftermath of expansionary fiscal shock – leads to higher demand for both domestic and foreign goods. Thus, in countries characterized by higher trade openness, part of the fiscal stimulus essentially leaks into the import channel, leading to higher imports (with exports unaffected), which in turn have a detrimental effect on the trade balance. Conversely, countries with a lower tendency to import tend to have higher fiscal multipliers.

- Source of financing and fiscal stance: Debt-financed fiscal stimulus is expected to have a larger expansionary effect than that of revenue-neutral fiscal policy (Abiad et al. 2016). Nevertheless, the effect may also be influenced by the country’s fiscal stance. In countries with high debt-to-GDP ratios, issuing of additional debt may increase sovereign risk premia, putting pressure on debt sustainability and eventually crowding out private investment.

- Business cycle: Most theoretical models do not predict higher multipliers during downturns, except for those that assume significant frictions (Ramey 2019). However, the empirical evidence points to larger multipliers in recessions than during periods of economic expansion (Auerbach and Gorodnichenko 2012).

- Interaction with monetary policy: The size of the fiscal multiplier is contingent on the monetary policy response. Fiscal policy fares better when coupled with monetary accommodation or zero lower bound on the nominal interest rates (Woodford 2011; Christiano et al. 2011) because central banks are unwilling to respond to inflationary pressures generated by positive fiscal shocks. However, the empirical evidence is rather mixed (see, for example, Klein and Winkler 2018; Ramey and Zubairy 2018).

- Labour market institutions: The institutional setting could perhaps explain differences in the effectiveness of fiscal policies between countries. Theory predicts that countries with more rigid labour markets would be expected to have larger fiscal multipliers; that is, minimum wages and stringent employment protection legislation imply reduced wage flexibility and, as such, tend to amplify the response of output to demand shocks (Woodford 2011).

The extent to which the magnitude of fiscal multipliers varies according to a country’s level of development ultimately remains an empirical question. For instance, one may argue that fiscal multipliers should be larger in emerging and developing economies than in advanced countries because the share of “hand-to-mouth” or non-Ricardian households 6 is undoubtedly higher in the former context (Brinca et al. 2016). However, it could also be that lower administration capacity and greater inefficiencies related to government spending dampen the output response in developing countries (Furceri and Li 2017).

Last, but not least, it is hard to draw conclusions on whether jobs have been created where they were needed, since the impact of fiscal policy on employment is not direct but derived from its effects on output. In addition, it is not possible to say anything about policy-specific transmission mechanisms that occur in the labour market, or the possibly heterogeneous employment response across different segments of the labour force. Some categories of workers are generally more susceptible than others to job losses during recessions. For instance, the 2008 crisis had a more detrimental impact on male blue-collar workers; in contrast, the COVID-19 crisis hit workers in sales and service sectors disproportionately – sectors in which women are over-represented. Correspondingly, generic countercyclical expansions could, perhaps, increase aggregate employment but are unlikely to induce job creation in those sectors that suffered the most, possibly contributing to further occupational polarization. 7

- Governments can induce changes in labour demand and supply through specific labour market policies and social protection programmes.

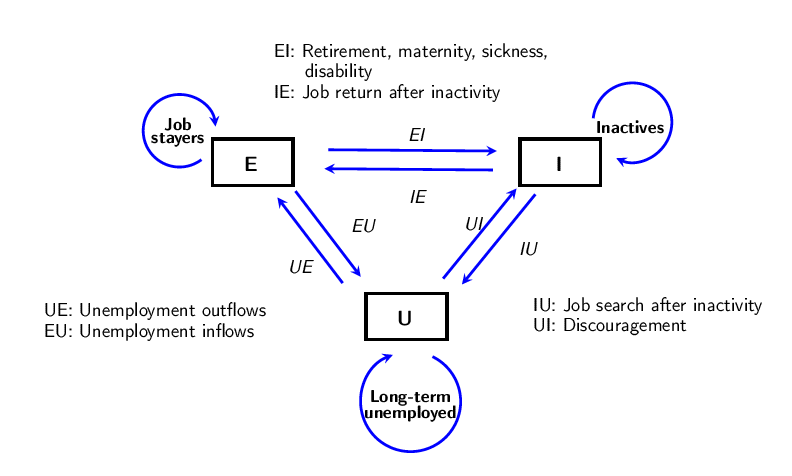

Active labour market policies (ALMPs) are publicly financed interventions intended to improve the functioning of the labour market by inducing changes in labour demand and labour supply, as well as their matching process. Specifically, these policies aim to preserve existing jobs and create new employment opportunities, encouraging labour market attachment and the reintegration of long-term unemployed and inactive individuals, and facilitating the job-search and job-matching process. In practice, they target labour market outsiders – all unemployed and inactive individuals.

The Organisation for Economic Co-ordination and Development (OECD) database classifies ALMPs into six broad categories: (i) training; (ii) employment incentives; (iii) direct job creation; (iv) start-up incentives; (v) public employment services and administration; (vi) sheltered and supported employment and rehabilitation.

Training-based programmes promote the reintegration and employability of unemployed individuals through skills acquisition. Employment subsidies are financial incentives paid to firms to either preserve existing jobs (e.g. short-time work schemes) or create new ones (e.g. hiring and wage subsidies) by reducing their wage bill. Start-up incentives encourage self-employment or prompt individuals to start their own businesses through the provision of loans and consulting services. Direct job creation, for instance public works schemes, are primarily used in developing countries to reduce unemployment and protect vulnerable households from negative shocks (e.g. macroeconomic, weather and idiosyncratic shocks). Public employment services (PES) facilitate the reintegration of welfare recipients (by the use of activation and sanction measures) and enhance the job-matching process by delivering job-search assistance, counselling and intermediation support. Finally, sheltered and supported employment and rehabilitation consists of subsidies and vocational rehabilitation for the productive employment of persons with a permanently (or long-term) reduced capacity to work.

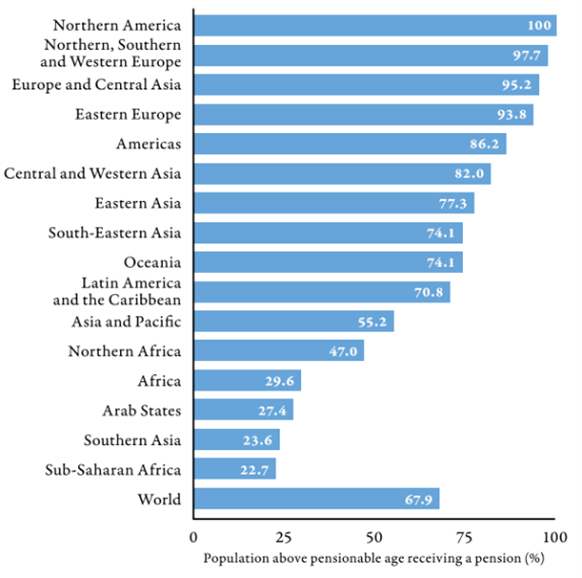

Social protection transfers: Unemployment insurance and unemployment assistance protect workers against labour market risks by providing them with income replacement in the event of a job loss (e.g. UBs). UBs act as automatic stabilizers for aggregate demand over the business cycle by smoothing the consumption of the unemployed (i.e. mitigating income fluctuations). Other social protection programmes, such as old-age pensions, disability benefits, family benefits, childcare and healthcare, are intended to increase the welfare of individuals and reduce or prevent poverty throughout their life cycle. Thus, the objectives of income support schemes go way beyond labour market outcomes as they represent important buffers against not only negative economic shocks but also idiosyncratic ones (such as disability). However, according to some commentators, overly generous income support schemes might be associated with work disincentives and a corresponding decline in labour supply.

When these interventions are directed at specific socio-demographic groups – such as low-skilled, informal workers, old-age workers, youth, disabled persons or women, for example – they have the potential to considerably reduce inequalities and promote labour market inclusiveness. We will discuss this throughout the paper using four dimensions – access, fairness, protection and voice – recently proposed by El-Ganainy et al. (2021). All social protection programmes entail a significant insurance component, thereby increasing protection, whereas ALMPs can facilitate labour market access of some groups that typically face discriminatory barriers, enhance their bargaining power (voice) and, consequently, reduce persistent wage gaps (thereby increasing fairness).

Since policies interact with each other, it is important to take into account complementarities and spillovers in the analysis of their effects.

Complementarities: In some cases, a policy is introduced to mitigate the risks associated with another policy. For instance, income support policies, such as unemployment and disability benefits, are likely to create work disincentives and might, therefore, be more effective when complemented by appropriate activation measures that strengthen work incentives, encourage reintegration and help welfare beneficiaries back into work (Boone and van Ours 2006). Therefore, one should expect a positive correlation between the two types of policy. In other instances, the policy mix is deliberately designed to compound the intended outcomes of individual interventions. For example, a policy package entailing PES and training programmes can strengthen the positive effects of both elements.

Substitution: Spillovers can occur even unintentionally, especially when there is a lack of policy coordination. Specifically, the effects of one policy could be partly offset by the existence of another. For instance, pension reforms (such as an increase in the statutory normal or early pensionable age) aim to increase the labour supply of senior workers and reduce pressure on public finances. However, the effectiveness of the reform will undoubtedly depend on the existence and generosity of alternative routes to retirement (e.g. disability and unemployment benefits). To put it another way, an increase in retirement age may increase the number of unemployment assistance or disability benefit claimants. At the same time, more generous UBs could considerably reduce enrolment in other social programmes (such as disability benefits), which are more difficult to access.

Literature review

The effectiveness of fiscal policy is typically assessed through the estimation of fiscal multipliers, posing questions such as: By how much does output rise in response to a 1 percentage point increase in government spending (or 1 per cent tax cut)? What factors shape the size of fiscal multipliers? However, in this framework, employment is only a “side-effect” derived from the output response. Another research stream examines the effects of various labour market institutions and structural reforms in the area of employment protection legislation, UBs, minimum wage and product market regulation, as well as their complementarities with economic shocks. The central hypothesis of these studies is that labour institutions lead to inefficiencies that prevent employment and productivity growth. The more recent evidence is based on impulse response functions (i.e. local projections) that address the following set of questions: Does a reduction in UBs (shock) – or a 1 percentage point increase in public spending on ALMPs – affect unemployment and, if so, how quickly do effects materialize? Does the size of the impact depend on business cycle conditions and monetary policy regime? However, they are silent on the effect of specific policies, which is, in turn, addressed by a further research stream that attempts to explain variations in key labour market outcomes – unemployment, employment, wages or unemployment flows – corresponding to changes in specific policies (such as training, employment subsidies, disability benefits, family policies, UBs) and their complementarities. We will mostly comment on the signs and significance of the relationships because the magnitude of coefficients is not necessarily comparable across studies due to differences in methodology and indicators used. 8

In contrast, the impact evaluation literature examining the effects of specific fiscally relevant policies has relied either on randomized control trials or quasi-experimental approaches (difference in difference, propensity score matching, regression discontinuity). These studies typically compare the mean outcomes between treatment and control groups, and respond to the question: What is the impact of a programme (i.e. hiring subsidies) on an outcome of interest (e.g. target group) if all other things are equal?

2.1 Fiscal multipliers

The research on fiscal multipliers is a long way from delivering a consensual view, due to differences in underlying assumptions and modelling approaches (e.g. dynamic stochastic general equilibrium (DSGE) and real business cycle (RBC) modelling predict a decline in consumption, whereas backward-looking models with a Keynesian flavour suggest higher consumption). Apart from methodology, 9 the magnitude of fiscal multipliers depends on the economic context and type of stimulus. Gechert (2015), using meta-regression analysis based on 104 empirical and simulation-based studies, concludes that public spending multipliers range from 0.7 to 1. 10 Tax reliefs and transfers yield significantly lower multipliers (by 0.3–0.4 units), while public investment delivers a multiplier that is larger in size (by 0.6 units). Nevertheless, the general findings are in line with the theoretical predictions about country specificities. First, the fiscal multiplier tends to be lower in more open economies. Economies with a higher import-to-GDP share have lower multipliers due to leakage via the import channel. Second, the higher the share of non-Ricardian agents, the higher is the fiscal multiplier. Third, when central banks pursue inflation-targeting measures by following some form of Taylor rule, a monetary response partly crowds out investment and/or consumption through an increase in the real interest rate, leading to lower multipliers. In contrast, fixed real interest rates or a zero lower bound regime leads to higher multipliers.

However, this meta-analysis does not reveal anything about the extent to which the level of development influences disparities between economies. To gain an insight into this issue, we examine findings from two relatively recent studies that use the same method to estimate fiscal multipliers but focus on different country groups (advanced countries versus emerging and developing countries). Abiad et al. (2016), using local projections, examine the effect of public investment in 17 advanced economies over the period 1985–2013 and find that the short-term fiscal multiplier is around 0.4, whereas the medium-term one is about 1.4. The authors show that the expansionary effect is higher during periods of economic slack and monetary accommodation. Moreover, debt-financed public investments are more effective than budget-neutral measures in boosting output and reducing unemployment and, more importantly, without increasing funding costs (proxied by domestic real interest rates). Furceri and Li (2017) corroborate some of these findings using the sample of emerging and developing economies from the period 1990–2013; specifically, fiscal multipliers are higher during periods of low economic growth and in the presence of more efficient public investments. However, the magnitude of the public investment multiplier is much smaller than in advanced economies (0.2). In contrast with Abiad et al. (2016), Furceri and Li show that fiscal policy is virtually ineffective in countries characterized by high levels of debt as it increases the pressures on public debt sustainability, which in turn raises interest rates, offsetting the initial positive effects. Furthermore, in line with theoretical predictions, they suggest that the fiscal multiplier is higher under fixed 11 than under flexible exchange rate regimes and higher in countries characterized by lower import propensity. Conversely, the output is unresponsive to fiscal stimulus in countries marked by high trade openness. To summarize, multipliers in emerging and developing economies are smaller than those in advanced economies, particularly when public debt is high and in the case of flexible exchange rate regimes.

Furthermore, Lastauskas and Stakėnas (2020) estimate the reaction of impulse response functions to reforms in UBs and spending on ALMPs using local projections. Specifically, they examine whether their impact is shaped by an economy’s monetary policy stance (accommodation versus tightening) and its monetary policy regime (before the introduction of the euro and afterwards). According to their estimates, more generous UBs strategies tend to increase unemployment unless they are implemented under monetary policy accommodation. Likewise, ALMPs are only effective at reducing unemployment in the latter context. Moreover, as a response to a 1 per cent increase in UBs replacement rates, the real effective exchange rate depreciates in an environment of independent monetary policy and monetary tightening, while there is no effect under monetary accommodation. In contrast, the real effective exchange rate tends to appreciate under conditions of loosening monetary policy and depreciate marginally in a scenario of tightening monetary policy within the monetary union, implying that any loss in a country’s competitiveness is amplified under monetary union. Overall, these findings shed light on the importance of accounting for monetary policy stance and regime – an issue on which cross-country evidence from panel regressions is virtually silent. Along the same lines, Duval and Furceri (2018) show that increased public spending on ALMPs has larger employment effects during periods of economic slack, which is in line with the literature on fiscal multipliers. In contrast, while expansionary during good times, a reform entailing a reduction in the generosity of UBs is contractionary in periods of low growth, due to the negative demand effect.

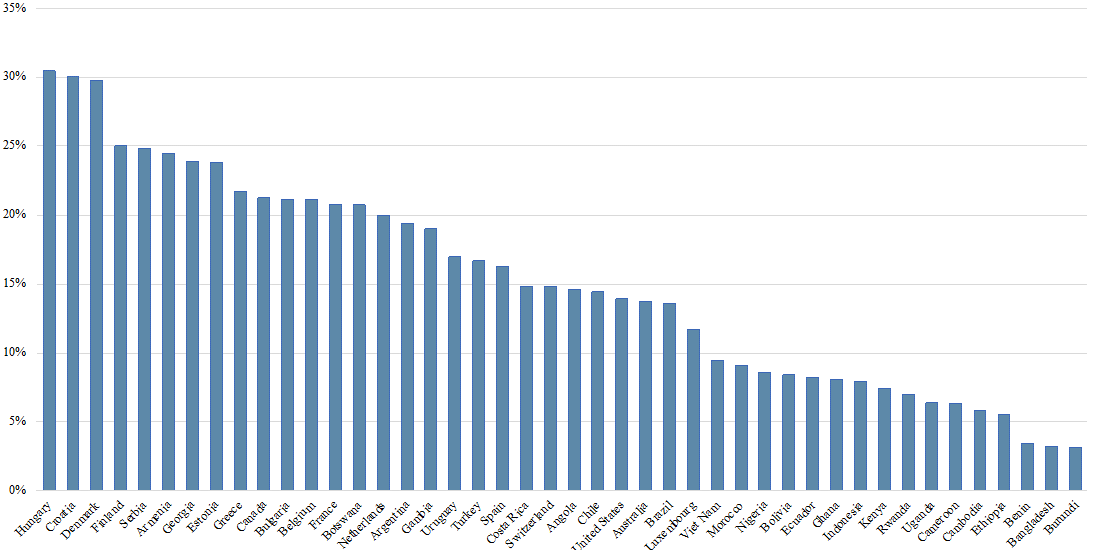

2.2 Direct public job creation

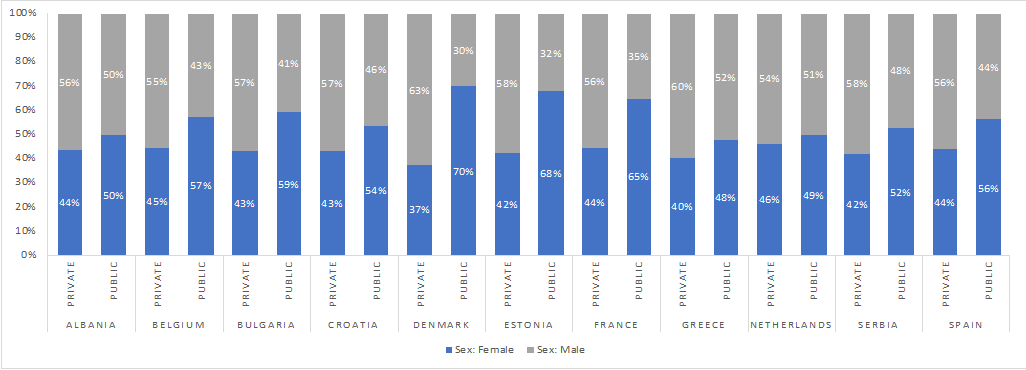

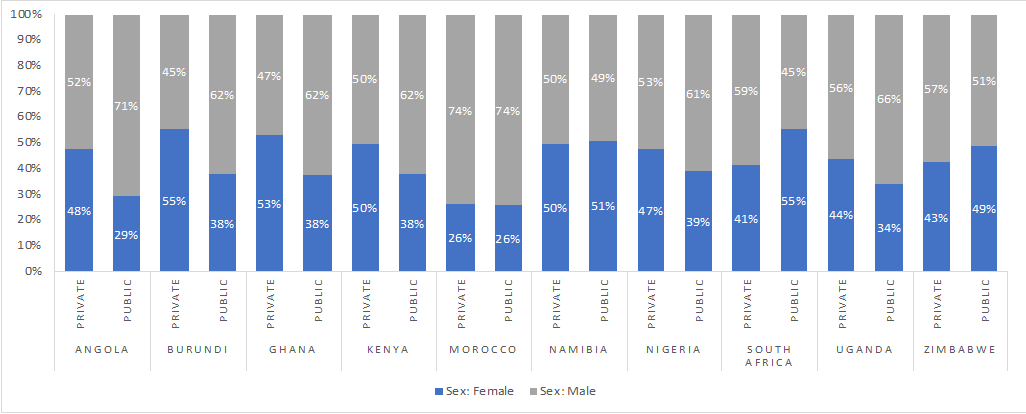

To produce public goods and provide public services, governments require labour inputs. Indeed, public sector employment represents a large labour market segment in developed countries, although its share in total employment varies significantly across countries, as reported in Figure A2. It ranges from 15 to 30 per cent of total employment in selected European economies, while the size of the public sector in developing countries is much smaller. Public sector wages therefore represent a significant segment of government expenditure. Moreover, in all European countries, gender employment gaps exist in the private sector – with men outnumbering women in all countries under consideration – while gender equality has been achieved (and in some instances overachieved) in the public sector (see Figure A3). The opposite holds true for selected African countries for which data is available (see Figure A4).

This descriptive evidence makes us question whether governments could promote labour market inclusiveness in terms of access and fairness. Generally, public sector wages are regulated, transparent and less dispersed than those in the private sector (Garibaldi and Gomes 2020). Thus, workers performing the same job are typically paid equally irrespective of their productivity, age, gender or race. Many governments reduce persistent employment and wage gaps in marginalized groups through public sector employment policies and public works schemes, leading to a corresponding increase in their bargaining power (voice) with additional positive spillover effects in the private sector (Caponi 2017).

During periods of economic slack, governments can directly increase the quantity (as well as the quality) of available jobs through expansion of public sector employment 12 (e.g. healthcare and education workers and public administration posts). Direct job creation may also reduce the informality rate by facilitating the integration of informal workers into the public sector, which is normally characterized by lower rates of informality. On the other hand, governments may also act as an “employer of last resort” through public works schemes. In the latter context, the government’s intention is to directly create temporary public employment in order to provide income support to the most vulnerable. This policy is popular in developing countries as it acts a safety net against negative shocks (e.g. weather shocks, macroeconomic shocks, idiosyncratic shocks), thereby preventing or reducing poverty (Subbarao et al. 2012).

Hence, direct public job creation – under the assumption that private-sector employment and labour force participation are both fixed – will lead to lower unemployment stock. However, these two components of public sectors are likely to have different implications for labour flows, whereby the former are characterized by higher stability, i.e. lower inflows and outflows of public employment (Garibaldi and Gomes 2020). In contrast, public works schemes are often of short duration, thereby leading to higher flow rates.

A rise in public employment may also generate positive spillovers, in terms of local development and infrastructure and enhancing the quality of public services (e.g. healthcare, education and transport). 13 Similarly, targeted public employment policies can help to stimulate regional development and address regional disparities by expanding the employment opportunities in areas of high unemployment.

2.2.1 Effects on private sector employment, participation and net unemployment

The theoretical framework proposed in Algan et al. (2002) starts from a basic assumption: workers choose to supply labour either to the private or the public sector. Firms pay wages equivalent to the marginal product of labour while governments do not maximize profits and pay wages that are not necessarily contingent on productivity. Positive public–private wage differential – i.e. higher public job rents – gives more bargaining power to workers and generates a pool of jobseekers queuing for public sector jobs. To put it another way, higher public job rents make these jobs more attractive, crowding out private sector employment and putting pressure on private sector wages. Conversely, if public–private wage differentials are small, the crowding-out effect will be negligible. Note that in the case of monopsony, both employment and wage equilibrium levels are lower than they would have been under conditions of perfect competition. Therefore, higher public wages – analogous to a rise in minimum wages – may lead to both higher wages and higher employment in the private sector. Furthermore, higher public job rents may increase labour force participation – for example among discouraged, inactive and informal workers – which in turn dampens (at least partly) the crowding-out effect as well as the intended effect on unemployment.

Furthermore, an increase in public sector employment could also induce a shift in the composition of private sector employment from more productive tradeable sectors to less productive non-tradeable sectors, without affecting total private sector employment but reducing the country’s competitiveness (Faggio and Overman 2014). Assuming that the public sector produces non-tradable goods and services, when public and private activities are complementary, an increase in public sector employment could crowd in private sector jobs by reducing unemployment and increasing aggregate demand (Dale-Olsen and Schøne 2020). At the same time, higher wages may crowd out private employment in the tradable sector, given that exporting firms are price takers in international markets and cannot compensate for a rise in labour cost by increasing prices (Garibaldi and Gomes 2020).

To summarize, direct public job creation may, first, reduce unemployment rates and, second, increase labour force participation and decrease informality rates by facilitating the reintegration of discouraged, inactive and informal workers. Needless to say, if an increase in labour supply exceeds the number of available jobs under the public works scheme, this will lead to higher unemployment rates. The third effect of direct job creation is to increase the wage level if the public–private wage gap is positive, but it may also crowd out private sector jobs. Therefore, theoretical predictions about the net unemployment effect are ambiguous and remain an empirical question.

In what follows, we analyse several studies that explored the labour market effects of public employment at the micro and macro level, reporting mixed results.

2.2.2 Some evidence on public sector employment in advanced countries

The cross-country evidence for developed countries within the literature on the private–public sector nexus suggests that the crowding-out effect typically prevails, eventually dampening or reversing the net unemployment effect. For instance, Algan et al. (2002) use the OECD cross-country data over the long period 1960–2000 to estimate the impact of public sector employment on labour market outcomes. They find that, on average, for every 10 jobs created in the public sector, 15 private sector jobs are displaced. However, the issue of endogeneity looms large in their analysis. Considering the long time span, they account for the time effect by assuming that it is the same across countries (failing to control for country-specific trends), which might have considerably affected their variables of interest. Similarly, recent empirical findings from both advanced and developing countries (Behar and Mok 2019) suggest that public jobs (at least partly) crowd out private jobs, albeit to a lesser degree in developing countries, while the impact on net unemployment is statistically insignificant. The authors’ decision to pool advanced and developing countries is problematic because structural and institutional differences between these two country groups are substantial. In line with this, Stepanyan and Leigh (2015) show that public jobs displace private ones, especially in countries with high public wage premiums and higher rates of substitution in the production market between the private and public sectors. However, the results are not robust when they split the sample of middle-income countries according to their different institutional settings – the negative public employment effect on unemployment that was initially found disappears. Instead, Gal and Theising (2015) show that public employment correlates positively with the aggregate labour force participation rate and – in some specifications – also with the employment rate, while the relationship with unemployment is never statistically different from zero. It seems to benefit all skill groups, although the magnitude of the public sector coefficient is higher for the middle-skilled. Finally, in terms of unemployment flows, De Serres et al. (2012) show that direct job creation reduces significantly both inflows into and outflows from unemployment. They also find that this holds for all sub-populations (youth, “prime-age” women, and men), although the negative effect on the unemployment inflows is more pronounced for youth relative to other groups. Likewise, Ernst (2015) finds that direct job creation significantly reduces unemployment inflows, but its impact on unemployment outflows, while positive, is not statistically different from zero.

Another question explored is the degree to which public sector employment is crowding out private employment along the business cycle. Using the local projections method, Lamo et al. (2016) find that public employment crowds in private sector employment during periods of high unemployment and recessions, while the opposite is true in “normal” times, when the economy is not in a recessionary phase. 14 Furthermore, they find that private-sector wages increase in response to the rise in public wages irrespective of the business cycle in the euro area.

The microeconometric evidence suggests that the effect of public sector employment on private jobs is more relevant at the local level. A recent impact evaluation study based on Norwegian administrative data reveals that new public establishments positively affect private sector employment, wages and sales located in their proximity (Dale-Olsen and Schøne 2020). Specifically, for every 10 jobs created in the public sector, 1.3 additional jobs are created locally in the private sector. They point out that the effect is relatively larger in the private sectors that are closely related to public activities (e.g. “Education, health and social services”). Faggio (2019) reaches similar conclusions using the UK data, suggesting that the positive spillover effects are highly localized. The author argues that for every 10 public jobs, 11 private sector jobs are crowded in locally. Importantly, the multiplier effect is significant in the service sector, implying a compositional employment shift towards services. This new empirical evidence appears to strengthen the case for public job creation as an intervention intended to support local development and growth. However, the compositional shift from tradeable to non-tradeable sectors (e.g. construction), could have a dampening effect on the country’s competitiveness (Faggio and Overman 2014).

In conclusion, there is still a substantial research gap in this area. The empirical evidence is relatively scarce and mixed results emerge. While some studies suggest that public jobs crowd out jobs in the private sector, others find positive local spillover effects on private sector employment or compositional changes. Cross-country studies typically fail to isolate causation from the correlation, which effectively leads to an overestimation of the crowding-out effect. Therefore, further research efforts – which take into account the interactions between public and private sectors – are necessary to gain a clearer insight into the extent to which public sector employment affects not only private sector employment but labour market inclusivity as well.

2.2.3 Some evidence on public works in developing countries

Key among ALMPs in developing countries are public works schemes (see Subbarao et al. 2012). Much research has been done on the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) in India, one of the largest public works programmes in the world, active since 2006 (see Box 1 for details). According to Azam (2012), the scheme generated positive effects on employment, labour force participation and wages. Moreover, it both encouraged females to participate in the labour force and boosted their wages (by 8 per cent). Berg et al. (2014) corroborate these findings, suggesting that effects are persistent over time and concentrated in districts characterized by a more efficient programme implementation. In line with this, Imbert and Papp (2015) show that the scheme substantially increased private sector wages for casual labour (by 4.7 per cent). Nevertheless, they argue that the scheme created distortions in the labour market as public employment for men increased at the expense of the private sector (i.e. due to the crowding-out effect). Zimmermann (2020) challenged Imbert and Papp’s results, finding no evidence of public works displacing private sector jobs but rather occupational changes from private casual jobs to family employment. Essentially, MGNREGS, acting as a safety net, mitigates the insecurity associated with the latter form of employment.

Altogether, the Indian public works scheme enhanced the bargaining power of beneficiaries by paying a minimum wage, which in turn put upward pressure on the agricultural market wages (normally set below the legal minimum). Muralidharan et al. (2018) estimate general equilibrium effects and offer persuasive evidence that the programme considerably increased the income of vulnerable households and reduced poverty, not only through direct wages but also through indirect channels. Specifically, while the programme accounts only for 15 per cent of the rise in income, the remaining 85 per cent is due to the increases in private sector wages. They find that higher private sector wages induced by MGNREGS led to higher levels of employment in both agricultural and non-agricultural sectors (e.g. manufacturing and construction, wholesale and retail). However, profits from land ownership declined in line with wage increases, especially in areas characterized by more concentrated landholdings. Finally, income gains translated into higher consumption rather than savings, boosting local demand and stimulating broader economic activities.

The impact evaluation studies on the effect of public works in Latin America and the Caribbean (LAC) deliver somewhat mixed results: the Peruvian workfare scheme (Construyendo Perú) increased both labour force participation and employment while, in Colombia, Empleos en Acción positively affected female earnings; in contrast, the Bolivian programme PLANE had adverse effects on both employment and wages (Escudero et al. 2017).

Some governments in Latin American have relied on combined approaches (i.e. income support coupled with activation measures). For instance, Escudero et al. (2020) examine the labour market outcomes of the public works scheme (Trabajo por Uruguay) and cash transfer (Ingreso Ciudadano) individually as well as considering their joint effect. The objective of the former was to provide temporary employment, increase the future employability of beneficiaries and enhance social inclusion, while the passive component aimed to provide monetary support to vulnerable households and assist them in meeting their basic needs. The study does not find any statistically significant effect on their variables of interest – labour market status (employed, unemployed, inactive) and job quality (hours worked, hourly earnings, working poor). Overall, it seems that the workfare programme in Uruguay was unsuccessful in delivering concrete labour market outcomes. The authors suggest that a possible explanation for such unsatisfactory results was the relatively short duration of Trabajo por Uruguay, which did not suffice to increase the employability of its beneficiaries (Escudero et al. 2017; 2020). Another assessment by Amarante et al. (2011), however, suggests that it had adverse effects on employment and wages for recipients in comparison to non-recipients (especially for men).

Box 1. Mahatma Gandhi National Rural Employment Guarantee Scheme, India

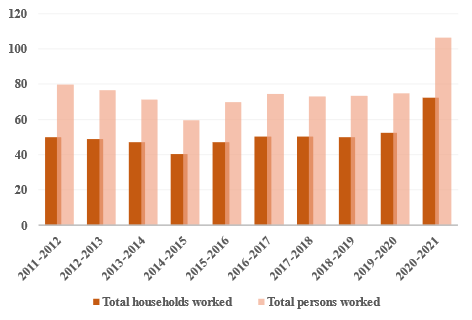

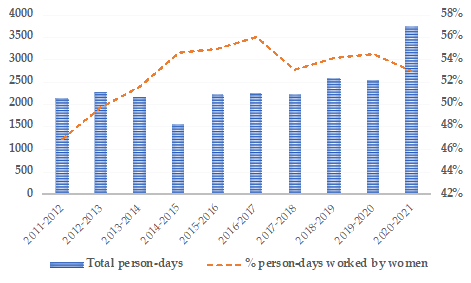

The Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) in India introduced a right to (public) work for up to 100 days annually at the legal minimum wage for all rural households. On average, MGNREGS reaches around 50 million households and about 70 million individuals annually. 15 The figure below reports the number of households and individuals who benefited from the scheme over the past decade.

The underlying mechanism, based on self-selection into employment, allows agricultural households to demand jobs when they need them. Hence, it has the potential to increase labour force participation and the employment rate if inactive or unemployed individuals apply for the scheme. It also represents an opportunity to reduce the gender disparities in rural India by requiring that at least one-third of recipients are women and providing equal pay for women and men. 16 According to the administrative data, the scheme’s gender quota is overreached, as more than half of the total person-days are worked by women. 17

2.3 Active labour market programmes

2.3.1 Public employment services

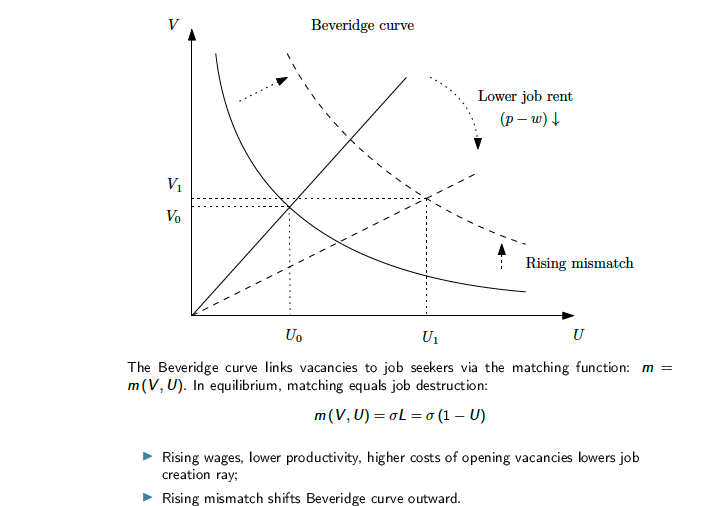

Public employment services (PES) help to reduce the mismatch between labour demand and labour supply. By providing job-search assistance to unemployed individuals, PES intend to overcome market failures arising from imperfect information. Similarly, they can facilitate higher-quality job matches by assessing the available vacancies and matching them with jobseekers’ profiles. The intermediating role of the job placement agencies between jobseekers and employers may facilitate the adaptation of jobseekers’ skills to the needs of the local labour market and enhance the productivity of the local firms. In addition, the counselling and monitoring role of PES aims to minimize the work disincentives that can potentially arise from generous protective labour market policies and facilitate the reintegration of inactive welfare beneficiaries. Strengthening the role of PES is perhaps even more relevant in the context of developing countries characterized by high informality rates, where hiring usually takes place via informal channels (Escudero 2018).

However, these positive effects could be considerably weakened by deadweight costs, i.e. providing job-search assistance to individuals who would have been re-employed even in the absence of support. In addition, public placement agencies are increasingly outsourcing their services to private agencies with the alleged goal of increasing cost-efficiency, leading to two additional risks (Behaghel et al. 2014): namely, “cream-skimming”, which occurs when placement agents select for the programme those individuals with higher employability chances (e.g. the highly skilled) instead of hard-to-place unemployed persons, and providing only the bare minimum of services to the second group (so-called “parking”). While not entirely avoidable, these practices can be minimized by having an appropriate contract structure in place. For instance, if the payment structure foresees large upfront payments to private service providers, then private (and profit-maximizing) agencies have an incentive to maximize the number of enrolments in the programme at the expense of the quality of service delivered (parking). However, if payments are performance-based (i.e. contingent on successful job placements), concerns about cream-skimming or “cherry-picking” risks arise. Thus, the design of the outsourcing contract structure remains crucial to balance these risks.

Empirical evidence

There is some consensus in the empirical literature on the effectiveness of PES. Both microeconometric (Card et al. 2018) and macroeconometric studies point to their positive labour market effects. The evidence from OECD countries suggests that higher expenditure on PES effectively reduces unemployment rates (Bassanini and Duval 2006; Boone and van Ours 2004). De Serres et al. (2012), using cross-country data covering the period 1987–2007, show that PES decrease inflow and increase outflow rates from unemployment. This is (partly) in contrast with Ernst (2015), who shows that the spending on PES increases unemployment inflows, implying that PES is likely to benefit the transition of inactive individuals back to the market, in line with the activating role of PES.

On the other hand, there is somewhat less consensus when public employment services are outsourced to private agencies. The results from Behaghel et al. (2014) challenge the standard expectation that private job placement agencies are expected to be more efficient than public ones, finding that public providers outperform the former using a randomized experiment in France. Essentially, private providers maximize the enrolment of jobseekers at the expense of the quality of service provided (i.e. with minimum effort) due to large upfront payments rather than the cream-skimming effect. In terms of decreasing total unemployment duration, public agencies fare better than private ones. In specific terms, private agencies do not reduce the total number of days spent unemployed, while PES does decrease the duration of unemployment by around 7 per cent, thereby generating UBs savings. Altogether, their findings imply that job counselling is an effective tool in increasing the employability of UBs recipients, albeit outsourcing this service to private providers is suboptimal. Similar results emerge for contracting out job placement services in Germany. Krug and Stephan (2013) find that public programmes outperform private ones in the short term, although their respective effects converge after a year and a half. Furthermore, Rehwald et al. (2017) compare the effectiveness of public and private providers in raising the job-finding rates of highly educated unemployed individuals in Denmark. Their results suggest that differences between the two are not significant at conventional levels. However, from a cost-efficiency perspective, public providers fare better as financing costs are higher for the provision of private employment services.

While previous studies are silent on the net aggregate effects, Crépon et al. (2013) explore both direct and indirect effects (i.e. displacement) of private job-counselling programmes targeted at young jobseekers with at least a two-year college degree in France. 18 The evidence from a randomized experiment implies that the employment effect among the treatment group is positive, but negative for untreated jobseekers. Correspondingly, the net employment effect is negligible. Moreover, they provide evidence that fixed-term jobs are not a “stepping-stone” into steady employment as the positive employment effect disappears one year after the treatment. Importantly, displacement effects are more pronounced during labour market slacks (when competition is stronger).

To conclude, the reviewed evidence from the selected studies favours public job-placement provision. However, this does not necessarily mean that private providers are inefficient per se, but it could be that the structure of payment (e.g. large upfront payments) may create perverse incentives. Surprisingly, however, no cream-skimming or cherry-picking occurs when job placement services are outsourced to private actors. Instead, there is some indication of the “parking” effect, i.e. skimping on the quality of services provided (Behaghel et al. 2014).

Some evidence points to a degree of complementarity between PES and other active and passive labour market policies. For instance, Blundell et al. (2004) examine the impact of the British “New Deal for the Young Unemployed” programme, which entailed a package of intervention measures (i.e. job-search assistance, wage subsidies, training and temporary government jobs) aimed at facilitating the transition into work of unemployment insurance claimants aged between 18 and 24. The authors focus on the programme’s two components: job-search assistance and the wage subsidy paid to the employer. They find that participation in the programme increased the transitions into employment of young men by around 5 percentage points, out of which one-fifth is due to the job-search assistance. While they do not investigate the long-term effects, they show that the programme appears to fare better in the first quarter compared to the subsequent periods.

2.3.2 Training-based programmes

Government-sponsored training programmes are intended to enhance the employment prospects of beneficiaries by providing them with either general or specific training through which they can acquire new technical and soft skills. In turn, this skill-upgrading promotes the reintegration of inactive and unemployed persons into the labour market and helps their career advancement, possibly leading to higher post-unemployment earnings (Brown and Koettl 2015). Furthermore, well-designed training schemes may reduce labour market mismatch if they can support workers in adapting their skills to the requirements of the local labour market. In addition to this, targeted training may facilitate occupational transitions and structural adjustments (Auer et al. 2008). Intuitively, displaced workers in “old” sectors could be retrained and matched with new, in-demand jobs in new sectors, thereby accommodating structural change and the evolution of industrial systems. Therefore, training-based ALMPs are expected to have a positive effect on the employment and matching process as well as on post-unemployment conditions (e.g. wages). However, these positive effects may be weakened by an adverse “locking-in” risk, when workers reduce their job-search activity during their programme participation, as well as considerable deadweight costs (Brown and Koettl 2015). In some cases, training schemes can even compensate for the lack of formal education and serve as a stepping-stone to longer‐term employment.

First-time jobseekers can face significant barriers to entering the labour market due to their lack of experience, especially in countries characterized by weak school-to-work bonds, a situation which is generally more pronounced during recessions. The youth unemployment rate in the OECD countries in the third quarter of 2021 ranged from less than 5 per cent in Japan to almost 40 per cent in Costa Rica (OECD 2021). Countries with a youth unemployment rate exceeding 20 per cent are also the countries with significant gender gaps (this gap was particularly large for Costa Rica, whose female youth unemployment rate was 15 percentage points higher than that of males). In addition, the ratio between the youth and prime-age unemployment rates reflects the disadvantaged position of youth in the labour market. According to the ILO, Southern Asia had the highest ratio of youth-to-adult unemployment in 2019, followed by South-Eastern Asia and the Pacific at 6.2 and the Arab States at 4. In advanced economies, Caliendo and Schmidl (2016) report that, in 2013, this ratio ranged from 1.6 in Germany to almost 4 in Sweden (the unemployment rate was four times higher for youth than for prime-age workers in the latter). These barriers and discriminations against youth may be substantially reduced by the use of ALMPs directed at youth and countries often rely on targeted training schemes (on-the-job training) or employment subsidies to tackle this issue.

Empirical evidence

The empirical evidence is not clear-cut. Most impact evaluation evidence on the effectiveness of training programmes in Latin America and the Caribbean, recently reviewed by Escudero et al. (2017), indicates significantly positive impacts on employment, earnings and the probability of being in formal employment. Several studies stressed that the positive impact on wages and employability is more pronounced for women and for youth. Hence, training programmes introduced in LAC, perhaps, made labour markets more inclusive in terms of access and fairness for these disadvantaged groups. In contrast, the effect of training on the employment of youth is ambiguous in Europe (Kluve 2010). The impact evaluation studies surveyed by Caliendo and Schmidl (2016) suggest that their impact is mostly positive in France and Germany and insignificant in Austria and Denmark, while a negative effect prevails in Norway and Sweden.

Even the evidence from aggregate cross-country analysis is somewhat mixed. Boone and van Ours (2004) and Escudero (2018) find that expenditure on training correlates positively with employment and negatively with the unemployment rate. However, De Serres et al. (2012) and Ernst (2015) find that training programmes increase both unemployment inflows – suggesting a return of inactive individuals to the market – and unemployment outflows, implying no, or only a limited, effect on the measured unemployment rate.

Some evidence from the United States calls for more sectoral-specific training methods that take into account the particular needs of in-demand jobs. Katz et al. (2020) review the evidence from four randomized control trials which suggest that sector-specific training programmes generate persistent improvements in earnings. These programmes are introduced to train and place jobseekers in “high-quality” jobs in industries such as information technology (IT) and manufacturing, with strong current local labour demand where firms offer higher wages and career promotion opportunities. In essence, participants are screened pre-enrolment and accordingly placed into appropriate training schemes through which they can acquire in-demand skills that facilitate their entry to high-paying sectors. Importantly, they provide compelling evidence that screening and job-placement services underperform in the absence of complementary sectoral occupational skills training, which acts as a “stepping-stone” for low-wage workers without university-level education to access high-wage, in-demand jobs.

The retraining programmes should help workers to adjust their skills so that they can gain the competencies required by new technologies. However, some argue that this skill-upgrading process is lengthy and costly, emphasizing the significant role that other public policies play (i.e. industrial and innovation policies). These two policies could be used to spearhead technological change, by creating (currently missing) incentives for the adoption of labour-friendly technologies and matching technology with existing skills, rather than the other way round (Rodrik and Stantcheva 2021).

2.3.3 Employment subsidies

Governments may induce changes in unemployment flows by providing financial incentives to firms, in the form of direct transfers or tax credits, which affect their hiring and firing decisions. Employment subsidies can be grouped according to their objectives into employment retention schemes, wage subsidies and hiring subsidies.

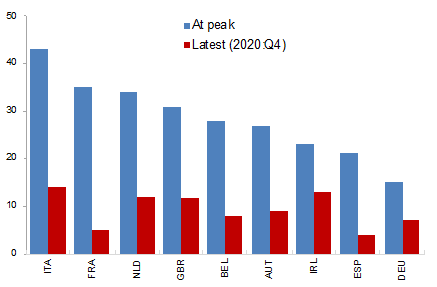

Employment retention schemes are publicly funded measures aimed at preserving at-risk jobs. They are (typically) temporary interventions that were used extensively during the 2008 financial crisis, but also recently as a response to the COVID-19 crisis. Most of the advanced and emerging economies have introduced these schemes in some form (e.g. Cassa integrazione in Italy; Kurzarbeit in Germany; the UK furlough scheme), which significantly reduced job losses (IMF 2021). 19 Figure A5 in the appendix reports take-up rates, which reached unprecedented highs in 2020, notably in Italy (43 per cent).

The employment retention schemes allow firms to adjust their labour inputs – along the intensive margin – in response to negative shocks (e.g. changes in demand) without having to dismiss staff, while the government reimburses eligible workers for the resulting loss of income. Correspondingly, they may be instrumental in preventing a surge in unemployment rates through lower unemployment inflows. Nevertheless, short-time work schemes can generate considerable deadweight costs, if subsidized jobs would have been retained in the absence of the subsidy, and displacement costs, if temporarily retained workers will be dismissed once the subsidy ends (Hijzen and Martin 2013). However, retaining employees, even temporarily, may prevent the erosion of skills that would have occurred if they were dismissed initially. In addition, employment retention schemes may also accentuate labour market segmentation (insiders versus outsiders) if atypical workers are not covered by them (Hijzen and Martin 2013). A further counterargument is that job retention schemes weaken the market selection mechanism (i.e. reallocation of workers from low- to high-productivity firms), which is typically more prominent during economic downturns, by allowing the survival of “zombie” firms. This, in turn, translates into lower aggregate productivity growth.

In contrast, wage and hiring subsidies are financial incentives offered to firms in order to expand employment opportunities. These interventions increase employment chances for outsiders and often target specific categories of workers, including (but not limited to) the long-term unemployed, low-skilled and other disadvantaged groups. The rationale behind employment subsidies is to compensate employers for the real or perceived lower productivity intrinsic to some categories of workers characterized by lower levels of skills or lack of experience. By reducing a firm’s wage bill, they may induce changes in firms’ hiring decisions.

Brown (2015) lays out the characteristics of the two alternative forms of employment subsidies – hiring versus wage subsidies – which we summarize as follows. First, wage subsidies may increase employment at both the intensive and extensive margins, while hiring subsidies affect only the latter. Second, both measures can generate considerable deadweight costs if they subsidize jobs that would have occurred anyway and displacement costs if they crowd out jobs elsewhere. Nevertheless, deadweight costs are generally higher for wage subsidies than for hiring subsidies as they target not only new hires but all employees with specific characteristics. In addition, the duration of wage subsidies may be considerably longer or even permanent. Third, targeted employment subsidies may induce a compositional change in labour demand (e.g. from medium-skilled to low-skilled workers) as they cause a change in relative labour costs between the eligible and non-eligible workforce population. This substitution effect substantially lessens the net employment effect. In the case of hiring subsidies, workers employed under a short-term hiring subsidy may be substituted by new subsidized hires once the subsidy ends, exacerbating job turnover rates without creating employment (“revolving door” effect). Fourth, employment subsidies may increase the earnings of eligible workers if they are able to capture a share of the matching rent, thereby reducing direct employment effects (Brown 2015). Nevertheless, this is unlikely to happen in a labour market characterized by high unemployment rates in which employers have bargaining power over workers (Boockmann 2015). Finally, when it comes to the fiscal implications, wage subsidies have higher financing costs than hiring subsidies. The latter typically cover a smaller proportion of the workforce, relative to the former. In other words, wage subsidies are directed not only at unemployed persons but at all employees with specific characteristics. For instance, Brown et al. (2011) report that the hiring schemes targeting the long-term unemployed concerned only 2.2 per cent of the workforce, while the affected segment of the workforce population was significantly larger in the case of low-wage subsidies, amounting to 13.6 per cent. If these interventions are effective in creating employment, they tend to be self-financing over time through an increase in tax revenues from newly employed workers and fiscal savings resulting from reduced unemployment outflows (e.g. lower UBs, means-tested income support). However, Brown et al. (2011) argue that this is unlikely in the case of wage subsidies due to the large deadweight costs they entail.

Furthermore, two additional positive effects may be at work once an employment subsidy is phased out: screening effect and skill formation (Brown 2015). First, in labour markets characterized by asymmetric information, they are used as a screening mechanism that enables firms to learn about workers’ productivity, eventually leading to long-term employment. Second, during subsidized employment, workers could adapt or upgrade their skills through “learning-by-doing”, possibly enhancing their future employability (Brown and Koettl 2015). Moreover, hiring and wage subsidies can make labour markets more inclusive, provided that they are conditional on hiring specific categories of marginalized workers.

Altogether, while employment subsidies may reduce the unemployment rates of targeted groups, their net effect on employment creation (especially in the long term) and wages is ambiguous and remains an empirical question. Positive selection that generates significant deadweight costs is impossible to completely rule out, but it can be balanced with appropriate programme design.

Moving to the analysis of targeted employment subsidies, most of the available evidence suggests that wage subsidies directed at old-age workers are ineffective, as summarized in Boockmann (2015). For instance, Huttunen et al. (2013) investigate the effect of a low-wage subsidy introduced in Finland to increase demand for full-time senior workers (over 54 years old) earning between 900 and 2000 euros per month. This initiative took place in 2006 and lasted until 2010. Their analysis reveals that there are no significant employment or wage differences between eligible and ineligible members of the workforce population. The intervention did raise employment at the intensive margin for the oldest workers by inducing a shift from part-time to full-time jobs, but it did not incentivize new hires.

Jiménez-Martín et al. (2019) investigate the effectiveness of hiring subsidies as a tool to improve the chance of being employed for people with disabilities in Spain during the period 1990–2014. On average, the hiring programmes do not appear to have improved the employment prospects of workers with disabilities. Nevertheless, the results show that hiring subsidies for permanent employment supported the unemployment outflows to permanent employment of senior workers. In contrast, a subsidy for contract conversion facilitated a shift from temporary to full-time jobs only for women. Furthermore, Baert (2016) shows that disclosing wage subsidy entitlement in the application of disabled candidates did not increase the probability of receiving a positive reaction from employers in Belgium. However, this discouraging result should be interpreted with some caution, considering that entitlement to wage subsidies may prove to be effective at later stages of the hiring process, by increasing the chances of getting a job that is beyond the author’s research scope. In any case, applicants with disabilities were almost 50 per cent less likely to get a positive call-back than non-disabled candidates, suggesting their unequal treatment in the Flemish labour market.

The evidence on the effectiveness of wage subsidies directed at youth is mixed (Caliendo and Schmidl 2016). Subsidized employment seems to have only a short-lived positive effect. Jordan introduced a pilot subsidy programme aimed at facilitating the school-to-work transition of female graduates. The amount of the financial support corresponded to the minimum wage and it was valid for a maximum period of six months. Groh et al. (2016) reveal that this incentive generated a large positive employment response in the short term, which vanished at the end of the subsidized period. The latter finding reduces the overall benefit of the programme and suggests that subsidized temporary jobs do not act as a “stepping-stone” to long-term employment.

Furthermore, Jaenichen and Stephan (2011) apply matching techniques to estimate the effect of wage subsidies in Germany. Employers could claim subsidies for hard-to-place workers that covered up to 50 per cent of the monthly wage for a maximum period of 12 months. According to their results, the wage subsidy considerably improved the employment prospects of participants; specifically, three years after the start of the programme, subsidized workers were more likely to be in regular employment in comparison to their non-participating unemployed counterparts. However, they find no significant differences in employment prospects between subsidized workers and unsubsidized workers that move directly into employment. The second piece of evidence may weaken the overall results, suggesting, as it does, high deadweight costs. Bernhard et al. (2008) evaluate the average effect of a short-term (up to three months) and medium-term (four to six months) wage subsidy targeted at “needy job-seekers” (i.e. unemployed persons receiving “unemployment benefit II” 20 ) on their employability. The authors find that, 20 months after entering into subsidized employment, the regular employment rate of the participants is 40 percentage points higher than within different control groups.

In Latin American countries, employment subsidies to the private sector appear to be an effective means of creating employment (Proempleo and REPRO in Argentina), and even for countering informality (Subsidio al Empleo Joven in Chile), while their impact on wages is found to be statistically insignificant (Escudero et al. 2017).

On the other hand, less targeted hiring subsidies appear to be more effective. To name one, Kangasharju’s (2007) assessment of the nationwide wage subsidy in Finland – available to all profitable firms – concludes that there has been a positive employment effect in subsidized firms. Additionally, he finds no supporting evidence for (expected) displacement effects on non-subsidized firms operating in the same industry and region.

The effectiveness of hiring subsidies during crises

Some literature analyses the effectiveness of hiring subsidies in encouraging the creation of new jobs during the global financial crisis. Among these studies, Cahuc et al. (2019) analyse the effect of hiring credits implemented in France in 2009 and show that the introduction of a hiring credit boosted the employment growth rate in eligible firms by 0.8 percentage points. The effect on the number of hours worked is similar to that for employment, suggesting that the substitution effect between incumbent employees and new hires was unlikely to have played a role. The authors underline that the subsidy’s temporary nature, the small subset of qualified firms involved and rigid wages were crucial ingredients for the programme’s effectiveness. Building on this study, Batut (2021) explores the medium-term effects and shows that subsidized employment creation persists even after the subsidy no longer applies. Neumark and Grijalva (2017), utilizing the database of state hiring tax credits in the United States, find positive employment effects of hiring subsidies during the Great Recession of 2007-2009. Also, they argue that some financial incentives perform better than others in creating jobs; specifically, refundable hiring credits and those with recapture clauses.

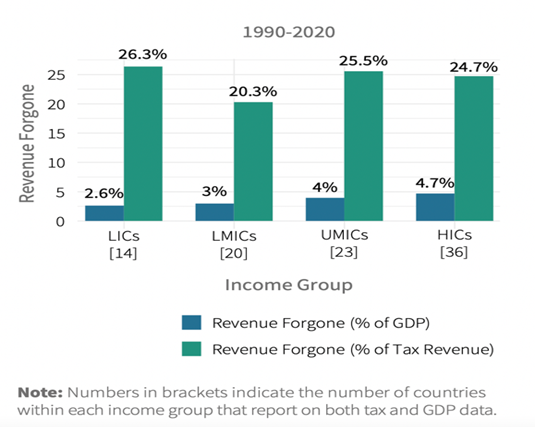

Tax policy to stimulate an inclusive labour market

Changes in payroll tax are another relevant instrument in this context, albeit these do not represent direct fiscal spending but rather foregone fiscal revenues. In what follows, we survey the empirical evidence from two reforms – a wide payroll tax cut in Colombia and a more targeted differential payroll tax reduction in Sweden. Note that general payroll tax reductions in developing countries are typically intended to encourage formal employment, hence pursuing an explicit goal of a change in the employment status and not necessarily the creation of employment.

In view of the country’s high informality rates, the Colombian Government introduced a tax reform 21 in 2012, which considerably reduced payroll tax, from 29.5 per cent to 16 per cent of wages, in an attempt to boost formal employment. In addition, the Colombian Government reduced existing corporate income tax from 33 per cent to 25 per cent and introduced a corporate profit tax of 9 per cent (Bernal et al. 2017). The measures therefore represented a form of revenue-neutral shift from labour to corporate taxes. Kugler et al. (2017) provide robust empirical evidence of an increase in formal employment as a result of the reform using individual-, household- and establishment-level data. They find heterogeneous employment responses across different firm-size classes and workers. In particular, the largest employment response is observed among small firms with fewer than ten employees and for female employees. Moreover, the payroll tax reform not only encouraged employment growth but also enhanced job quality in manufacturing (in terms of the level and share of permanent contracts). Likewise, Bernal et al. (2017), analysing firm-level data, suggest that, on average, the measures significantly increased formal employment and wages. As in Kugler et al. (2017), they show that the tax reform contributed more to employment growth in micro and small firms. In contrast, the employment effect is insignificant at conventional levels in manufacturing and large firms but positive and highly significant in labour-intensive service sectors. Finally, Fernández and Villar (2017) corroborate these findings using individual-level data but their results contrast with those of Kugler et al. (2017), suggesting that the measures predominantly reduced informality rates among workers with low educational attainment and prime-aged men. These studies highlight some relevant aspects of the Colombian payroll tax reduction reform. First, it expanded employment and reduced informality rates of the affected workforce population, irrespective of the level of analysis, methodologies and definitions of formal employment. Second, all studies emphasize heterogeneous employment response according to the firm-size classes. However, the long-term effects and net employment impact are less clear-cut.

Turning now to the evidence from an advanced country, we look at the impact of a targeted payroll tax reduction in Sweden. The reform halved the payroll tax for workers under the age of 27, with the objective of overcoming the country’s stubbornly high youth unemployment rates. Egebark and Kaunitz (2018) investigate the short-term impact on youth employment and wages outcomes, using a difference-in-difference approach, and report a small positive (0.27 per cent increase) but heterogeneous employment response and a negligible wage effect of the payroll tax reduction. Specifically, the employment response is higher among the youngest workers but statistically insignificant for foreign-born workers. Based on the cost–benefit analysis, the authors argue that positive effects are relatively marginal in terms of compensating for the high fiscal costs of the reform (i.e. on average, US$155,000 per job, or nearly four times the average hiring cost for the same age group). In 2015–2016, the Swedish youth preferential tax relief was revoked due to its negligible effects and the high fiscal costs it entailed. A recently published article by Saez et al. (2021) sheds new light on the measure’s long-term effects. The study reports that the long-run effects are twice as large as the medium-run, with a short-run impact of a 2.3-point increase in employment for the treated youth over the period 2010–2013 that becomes 4.4 points in 2014–2015, and finally reaching 6.3 points in 2016–2018, in the long run. They interpret this employment persistence even after a phase-out of the policy as “labour-demand-driven hysteresis”. Furthermore, the study looks at possible heterogeneities in the employment response by gender and region, concluding that tax reduction turns out to be more effective in regions characterized by higher youth unemployment rates (i.e. top quintile with unemployment higher than 20 per cent). It affected females and males equally in the medium term, while the positive impact for the former is higher after the subsidy was withdrawn. Finally, their fiscal cost calculation suggests that foregone revenues per job amount to less than US$60,000. This represents a substantial cost reduction in comparison to the earlier estimates by Egebark and Kaunitz (2018) – that the financial cost of the Swedish tax reform was high, while the effects on employment were small in the short run. The positive effects of any reform may take time to materializes, as underlined by Saez et al. (2021), implying possible limitations of a short-sighted analysis. A key takeaway from the Swedish evidence is that the effects of the labour market intervention took some time to materialize. Thus, one should be cautious when interpreting prevailing short-term impact estimates as some interventions may fare better in the long-term by “correcting” the behavioural responses of the affected actors (i.e. reducing existing discrimination towards certain demographic groups).

To summarize, private-sector employment incentives can take various forms (e.g. payroll tax reductions, vouchers, tax credits). They can be either broadly targeted (such as the payroll tax reform in Colombia) or narrowly targeted (as in the case of low-wage senior full-time workers in Finland). In addition, employment subsidies can operate at national or more granular levels, such as regions or industries that are struggling with high unemployment rates. Targeted employment subsidies aim to improve the labour market outcomes of specific groups of workers, but the evidence on their effectiveness is rather mixed.

Across a range of studies, results vary widely and are difficult to compare due to country-specific characteristics. In the case of old-age and disabled workers, the degree of discrimination, institutional settings and alternative policies in an economy are likely to be relevant factors in shaping employment outcomes. On the demand side, the lack of observed effects when these two specific groups were targeted could perhaps be explained by the presence of persistent discriminatory barriers. Meanwhile, on the supply side, the existence of “generous” early retirement schemes and disability benefits may weaken the effect of employment subsidies. In contrast, the extent to which hiring subsides are able to increase female employment may depend on complementary policies, such as the availability and generosity of family policies (e.g. childcare).

Furthermore, one study examines the labour market effects of public expenditure on employment incentives by pooling the cross-country OECD data over the period 1985–2016. After controlling for a rich set of variables – institutional, structural, economic and implementation factors – Escudero (2018) provides evidence that employment incentives decrease unemployment rates and increase employment rates. Moreover, the estimated impacts on employment, unemployment and participation rates are higher for low-skilled workers in comparison to the overall population.

Another less well-researched issue concerns the quality of the jobs that are created. It is important to consider not only the quantity of jobs but also their quality. If employment creation schemes are not conditional on the type of contractual arrangement (e.g. permanent versus temporary or part-time versus full-time) they risk exacerbating existing barriers to decent work and creating more atypical jobs. Insecure forms of work are often “traps” rather than “stepping-stones” (ILO 2016). Therefore, hiring subsidies for permanent and full-time contracts should be preferred in order to improve not only the employment quantity but also its quality, especially in those labour markets marked by duality.

Short-time work schemes in advanced countries

Unlike wage and hiring subsidies, there is much more consensus on the positive effects of employment retention schemes during crises, especially if the crises follow a V-shaped pattern (Cahuc 2019). A few studies are highlighted here. Hijzen and Martin (2013) investigate the role played by short-time work (STW) schemes, in 23 OECD countries, in preserving jobs during the financial crisis and the early stages of recovery. Their estimates suggest that STW schemes are effective at retaining jobs during the crisis, as previously found, but if not phased out during the recovery they may actually reduce employment. In addition, they also show that STW schemes not only preserve the existing jobs but may as well mitigate the negative unemployment impact of output shocks. Lydon et al. (2019) reach similar conclusions, pointing out that sectors with higher STW take-up rates exhibit fewer cyclical employment dynamics, suggesting that STW schemes fulfil a strong fiscal stabilizing function. Another study by Brey and Hertweck (2020) provides supporting evidence of STW reducing unemployment, although this effect fades out at higher take-up rates. Specifically, they show that the relationship between STW and unemployment is not linear but U-shaped. In line with earlier studies, STW emerges as highly countercyclical. Finally, the authors also reveal that STW is more effective in countries with pre-existing STW schemes than in countries with newly established ones. Furthermore, Kopp and Siegenthaler (2021), analysing the Swiss establishment-level panel data for the period 2007–2014, find that the use of STW increases the probability of establishment survival, preventing rather than simply delaying dismissals. Moreover, STW avoids a relatively larger number of layoffs in small establishments (with fewer than ten employees), exporting firms and those that operate in high-tech manufacturing sectors.

Nevertheless, the extensive use of STW schemes, apart from retaining jobs at risk, could undermine the market selection mechanism by reducing reallocation from low-productivity to high-productivity firms – adversely affecting aggregate productivity dynamics (Giupponi and Landais 2018). At the same time, however, the reduction in separation rates during economic downturns could generate long-term benefits for both firms and workers. It not only limits the disruption of firm-specific accumulated knowledge but also offers deferred cost reductions related to new hirings during the recovery phase. Moreover, it prevents huge and persistent wage losses of long-tenured workers displaced during economic contractions (Davis and von Wachter 2011).

STW schemes have been widely used during the COVID-19 pandemic to keep workers in their jobs and to maintain unemployment rates at low levels. 22 Several countries already had such schemes in place at the beginning of the crisis, but they have either made existing schemes more generous (e.g. Austria) and/or they have expanded them to include additional sectors and more vulnerable types of workers. For instance, Germany has relaxed eligibility requirements to include temporary agency workers. Similarly, workers in Switzerland on fixed-term contracts, apprentices, temporary workers, on-call workers and even family members helping in small firms benefited from these schemes, at least temporarily. It is, however, too early to evaluate the medium-term fiscal viability of these measures. Another issue which certainly deserves further analysis and discussion is the exit strategy to gradually phase out these measures.

2.3.4 In-work benefits

In contrast to the previously discussed employment subsidies paid to firms, in-work benefits are paid to employees with the intention of prompting changes in labour supply. In essence, they are redistributive instruments with the dual objective of creating work incentives and providing income support. Broadly speaking, they aim to sustain the labour market attachment of low-income workers by increasing their net income and, additionally, encourage inactive workers in receipt of means-tested benefits – that is entitlements conditional on the beneficiary’s income/wealth – to enter the labour market by increasing the gap between labour income and non-labour income, received by virtue of being out of work (Immervoll and Pearson 2009).

Workers must be employed and have income below a defined level to be entitled to in-work benefits. 23 Hence, while this approach encourages those outside the labour market to look for a job in order to gain access to in-work benefits, it may also discourage both those in work and those outside the labour market from working longer hours as they will be phased out from the scheme once their income passes the threshold (Boeri and van Ours 2008). Similarly, if eligibility is based on household income, in-work benefits may create work disincentives and have negative implications for the labour supply of secondary earners (i.e. married women). Of course, which effect will prevail undoubtedly depends on their design (i.e. eligibility and entitlement rules) as well as the country-specific institutional setting.

Apart from the positive effect on employment and participation rates, (generous) in-work benefits can also reduce the number of working poor by increasing the take-home income of eligible workers. Nevertheless, if these benefits are permanent, workers are likely to get stuck in low-wage “traps” deprived of career (and wage) advancement opportunities as they are disincentivized to invest in human capital (Brown and Koettl 2015).

The take-up of in-work tax credits will depend on the alternative options; for instance, the generosity of the existing social assistance schemes. In other words, the former – conditional on being employed – represents an alternative to the latter, as it discourages entry into and promotes exit from welfare programmes. Some evidence from the United States suggests that the Earned Income Tax Credit (EITC) scheme does indeed decrease the likelihood of claiming social protection benefits, but it does not pull beneficiaries out of the programme (Nichols and Rothstein 2016).

The rationale behind in-work tax credits is closely related to the level of the minimum wage. The latter is set to ensure a minimum adequate level of living standard, preventing the emergence of working poor. In other words, it helps low-skilled and low-income workers to earn sufficient labour income to stay out of poverty. Moreover, if firms have power over setting wages, it can even increase employment. 24 The standard counterargument to increasing the minimum wage level is that it could discourage demand for low-skilled workers, if their perceived productivity is lower than the binding minimum wage level – ultimately failing to fulfil its objective (Neumark 2018). This minimum wage effect on low-skilled employment strengthens the case for in-work benefits, which essentially shift the burden from firms to governments, generating significant fiscal costs.

In addition, labour supply change induced by in-work benefits may drive pre-tax wages down for both eligible and ineligible workers, ultimately benefiting employers rather than low-income workers (Rothstein 2009). In-work benefits can also create perverse incentives on the labour demand side. In countries with low minimum wages and generous in-work benefits, firms – in their efforts to reduce production costs – will be more prone to offer vacancies targeting in-work beneficiaries (i.e. paying the lowest possible wages in order to reduce their labour costs) – thereby exacerbating the prevalence of low-wage jobs. In a setting with a high binding minimum wage level, opportunistic firms’ behaviour and the wage moderation effect will be limited as wages cannot go below a certain level, leading us to question the extent to which targeted in-work benefits are actually able to support low-income households in the absence of adequate minimum wages.